There are various different types of physical collections that traders have set dollars into and enjoyed fantastic extensive-time period investment progress. Vintage vehicles is one such market, and wine is an additional.

The overall thinking is that the quick tax gain provided by present-day contributions outweighs the destructive tax implications of long term withdrawals.

If you are in a Lessen Tax Bracket Now If you are inside a lessen tax bracket now, but be expecting to become in the next tax bracket later on, then funding a tax-exempt account like a Roth IRA could seem sensible.

Some traders may well choose to skip a broad basket of REITs in lieu of a lot of the sector's sturdiest corners.

If you keep onto a bond till it matures, it is best to get again the total value of your principal investment—or par price.

Our recommendations are a fantastic place to begin, but All people requirements to make your mind up for on their own which prolonged-phrase investments sound right specified their own personal possibility tolerance and monetary plans.

Gain and prosper with the most beneficial of Kiplinger's advice on investing, taxes, retirement, personalized finance and much more. Sent day-to-day. Enter your electronic mail within the box and read here click Indicator Me Up.

Tax-exempt accounts offer long run tax benefits in lieu of tax breaks on contributions. Withdrawals at retirement will not be issue to taxes, matter to sure specifications—to get a Roth account, such as, It truly is as long as you've experienced the account for at least 5 years.

“Maintaining payments, if it can be achieved, will make use of lower asset charges and the compounding ability of early savings.”

Inflation spiked in 2022 to the best price in a lot more than 4 many years. It's got unquestionably cooled off a little bit due to the fact then, nevertheless it continues to be previously mentioned the Federal Reserve's two% concentrate on, and there's no assurance that it will not likely rise again.

The UK federal government troubles bonds often known as ‘gilts’, when their US federal government equivalents are termed ‘Treasuries’. IOUs issued by enterprises are generally known as ‘company bonds’.

These types of shares particularly are Among the many most secure long lasting investments, and supply dividends for money or reinvestment.

Rather than acquiring commodities right, Qualified buyers trade commodity futures contracts. Regular buyers should really stick to buying commodities resources.

Tax-deferred accounts present you with a worthwhile opportunity for taxpayers to make their savings on pre-tax pounds and likely lessen their tax Invoice. For those who aren’t absolutely sure the way you tap into these Advantages in your situation, seek out guidance from an experienced tax Qualified.

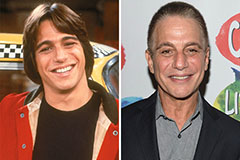

Tony Danza Then & Now!

Tony Danza Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!